The "Fractional" Risk-Reversal: Why Recruiter Deposits Should Be Refundable (January 2026)

Dover

January 27, 2026

•

4 mins

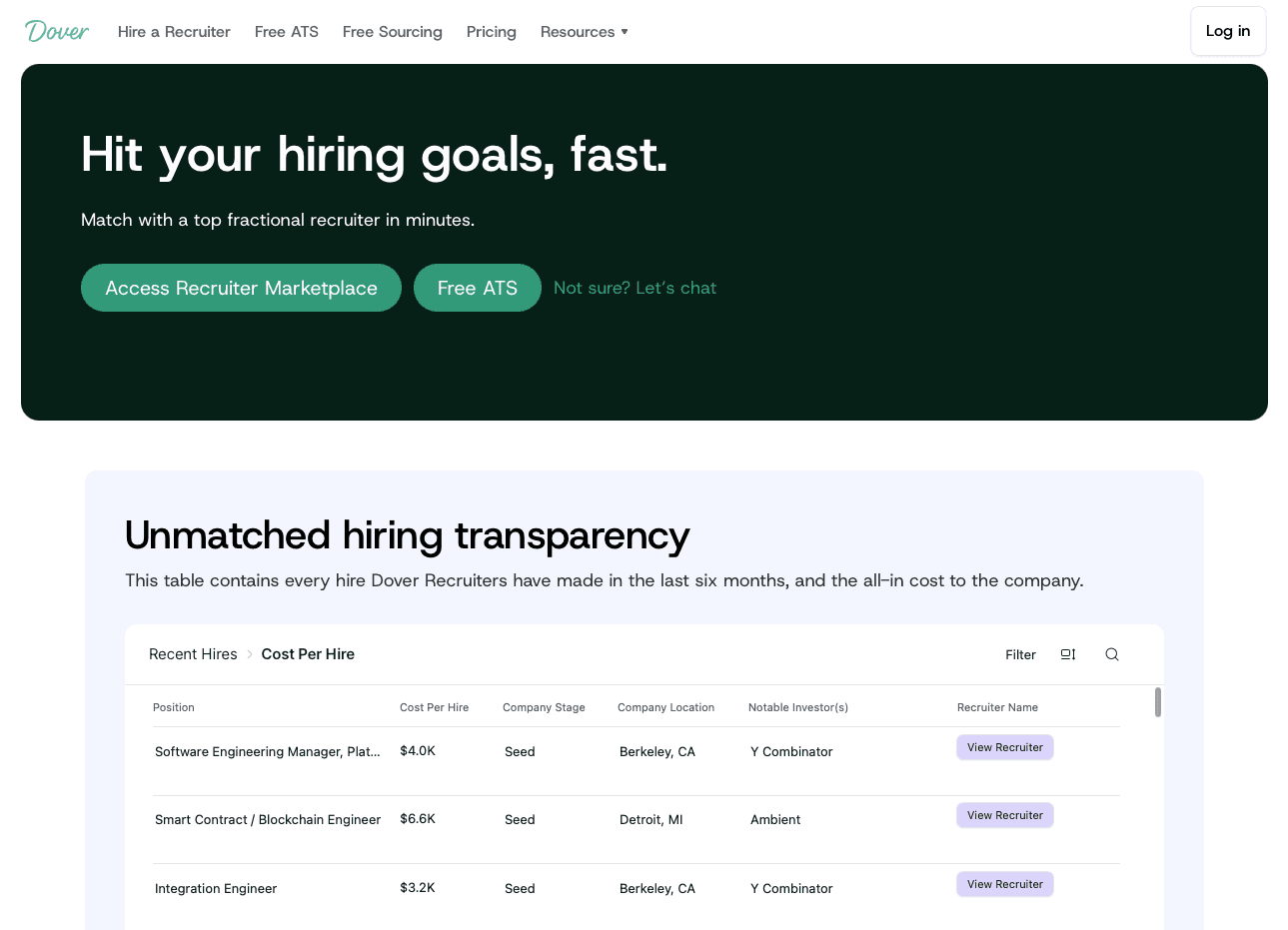

Fractional recruiting works like fractional CFOs or CMOs: you get an experienced recruiter billing by the hour, not a full-time employee or a traditional agency recruiter juggling dozens of clients.

LinkedIn profiles mentioning fractional leadership jumped from 2,000 in 2022 to 110,000 in 2024, a 55x increase in two years.

Traditional agencies charge 20-30% of first-year salary (often $30,000+) regardless of hours spent. Fractional recruiters charge for actual time worked. If a role fills quickly, you pay less. If it drags on, you still pay hourly instead of a fixed percentage.

The appeal: experienced recruiting help without a full-time hire or massive upfront fee.

Traditional recruiting agencies charge between 15% and 30% of a candidate's first-year salary. For a $150,000 engineering hire, that's $22,500 to $45,000 per placement, whether the recruiter spent 10 hours or 100 hours on the search.

The bigger issue is misaligned incentives. Agencies get paid when someone accepts an offer, not when that person succeeds long-term. This creates pressure to move fast and close deals instead of finding the right fit for your team and culture.

Many agencies also require exclusive agreements or retainers, locking you into working with one firm even if results aren't materializing. For startups watching every dollar, this structure feels backward: you're taking all the financial risk while the agency controls the process. If the hire doesn't work out in month two, you're out tens of thousands of dollars and back to square one.

Risk reversal turns transaction risk from buyer to seller through guarantees, refunds, or trials. In B2B services, this matters because a bad hire costs months and a considerable amount of money, while a poor recruiter wastes candidate goodwill and delays growth.

The fear of choosing wrong keeps buyers hesitant, even when they urgently need help. When a vendor offers "try us risk-free" or "get your money back if we don't deliver," they signal confidence and lower the psychological barrier to starting. For high-value services like recruiting, where a single bad placement can cost six figures, this often decides whether companies move forward or stay stuck.

The Psychology of Deposits: Why Refundability Builds Trust

A non-refundable deposit feels like sunk cost before work begins. You're mentally committed to seeing it through, even if red flags appear early. Refundable deposits flip this: you can walk away if things aren't working, which makes you more comfortable starting.

Buyers aren't assessing service quality alone. They're assessing their own decision-making under uncertainty. A refundable deposit signals "we're confident you'll be happy" instead of "we need to lock you in now."

Both parties stay committed. The buyer pays real money upfront, showing they're serious. The seller knows keeping that deposit requires delivering results quickly. Research shows 94% of consumers are more likely to stay loyal to brands offering complete transparency, and refundability is transparency in action.

When you know you can get your money back, the internal conversation changes from "can I afford to lose this?" to "does this feel like the right fit?"

Contract-Free Models: The Competitive Advantage of Flexibility

Contract-free models remove the anxiety of being stuck with the wrong choice. For startups, hiring needs swing wildly. You might need three engineers this quarter and zero next quarter. Long-term contracts force you to pay for services you don't need or manage termination clauses when priorities shift.

What no contract signals matters more. When a recruiting firm requires a six-month commitment, they need you locked in during their proof period. When they offer no contract, they're inviting you to judge their work every week and stay only if they earn it.

This creates accountability through market forces. Poor service means immediate churn. Good service keeps clients coming back voluntarily, which beats contractual obligation. You're a customer choosing to stay, not bound by legal terms.

How Refundable Deposits Change Buyer Behavior

Refundable deposits lower the barrier to starting, which shortens decision cycles and boosts conversion from consideration to engagement. Buyers move faster when exit costs disappear.

The paradox: refundable deposits typically generate fewer refund requests. Buyers who feel trapped fixate on every flaw to defend their sunk cost. Those who can leave freely judge the relationship on actual performance, building genuine loyalty through trust.

This matters in fractional recruiting because you're testing a relationship, not purchasing a finished deliverable. The first two weeks reveal whether a recruiter grasps your culture, matches your communication style, and sources candidates who fit. If that test succeeds, the deposit becomes irrelevant.

Pressured decisions produce shallow commitment. Voluntary choices that lead to staying signal real buy-in. Refundability selects for authentic fit over forced persistence.

Dover's Risk Reversal Approach: $800 Refundable Deposit and No Contracts

Frequently Asked Questions

Final Thoughts on Fractional Recruiting and Refundable Deposits

Table of contents